Market Pulse Check: Can we expect the market to sell-off further from here?

Given light positioning, the market is susceptible to more downside, but there is a chance that it could climb higher from this point on, albeit at a very gradual pace. I advocate selling rallies.

In my last blog on March 21, entitled Treasury Secretary Scott Bessent: "There are no guarantees there won't be a recession.", I said that it was a good time to sell stocks and the market subsequently took another leg down with the S&P 500 Index breaching beyond the 5000 level on 7 April.

The tariff plan President Trump introduced on ‘Liberation Day’ was significantly more hard-hitting than the markets had anticipated.

Given both the aforementioned breadth and depth of tariffs, growth will be dented, and there is a possibility of a mild US recession now in the coming quarters.

Liberation Day was a man-made disaster

Liberation Day accelerated a regime change and a new world order, which has been driven by heightened geopolitics, bigger fiscal deficits, a messy energy transition, and stickier inflation. This is a new era where we have shifted from benign globalization to one of great power competition.

For markets, it would pay well to reduce risk and diversify. Equity markets will likely be downgraded until there is more visibility on policy and growth. The dollar is likely to be further pressured, but at the same time, bond yields are not likely to rise higher.

Overall, market sentiment remains fragile.

Bear market studies

A recent study by Goldman Research showed that the average bear market takes about 20 months to recover. Structural bear markets on the other hand, take a longer time to recover.

Examples of structural bear markets would be the 1929 stock market crash, the downturn in Japan in 1990 and the Global Financial Crisis. Event driven bear markets, triggered by certain events, have shorter recoveries. For instance, the pandemic-induced sell-off in 2020 occurred for only a few months.

Goldman’s Bull/Bear market indicator - a function of Shiller P/E, Private Sector Financial Balance, unemployment rate, core inflation and ISM, revealed that we are likely approaching peak bullishness, and nowhere near the bottom of any bear market.

What should we trade in bear markets?

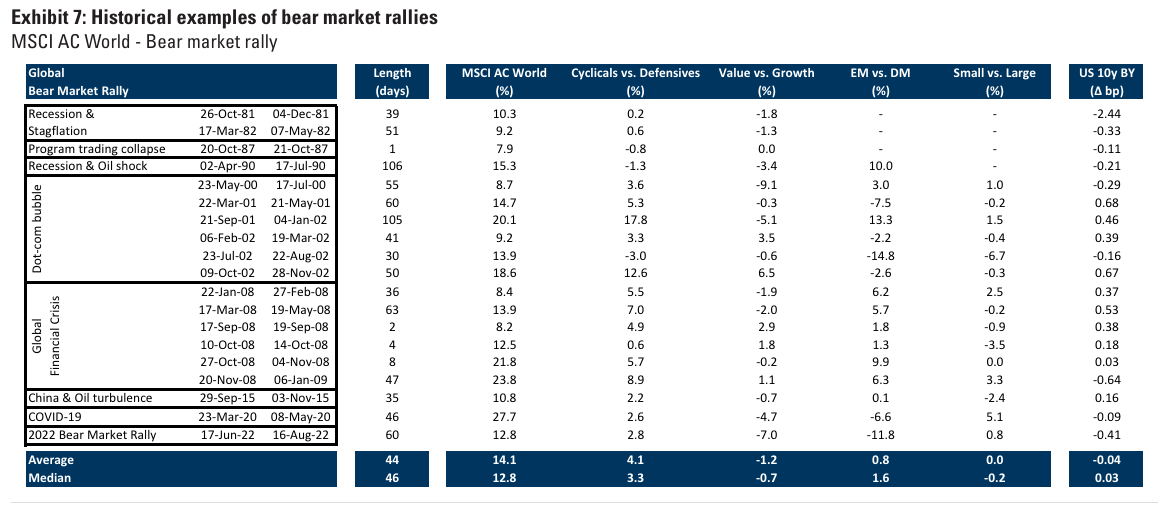

Driven by policy support and attractive valuations, equity market rallies during bear markets can be quite common. These rallies last 44 days on average, with cyclicals outperforming defensives 83% of the time, and by 4% on average. Emerging markets also outperform developed markets in bear market rallies (Don’t be surprised to see investors buying China and Indian companies in these run-ups).

On this point, valuations for non-US market stocks, such as those in Japan and the United Kingdom, are not as expensive as the US. In my view, these two markets would be the best ways to tactically play bear market rallies (i.e., short term trading in these markets make sense and don’t buy and hold them).

Another short-term trading idea would be oil and gas. Within sectors, we have seen the Russell 3000 Index energy stocks outperformed the overall benchmark by 10% for the year-to-date period. Oil and gas Exploration & Production companies have benefited from enhanced technology, improved investor sentiment and ongoing global demand amid the renewables transition. Further, oil companies have guided for capital efficiency gains in their 2025 outlooks, while some gas companies are planning for growth in a tightening market.

In the long run, there may be demand in the humanoid market

If you want to buy something for the long term, consider looking at humanoid stocks. Despite the recent dent in market sentiment due to tariffs, the longer term potential of the robotics industry remains intact. In particular, the adoption of humanoid robots is said to dramatically lower the cost curve of US manufacturers, which could give it a structural advantage versus nations with low-cost production.

Morgan Stanely suggests an approximate 85% total cost savings versus a US human worker, and a 20% humanoid penetration in manufacturing would allow the US to produce at cost parity with China. What’s more, between production and capital spending, Morgan Stanley sees humanoids growing into roughly an USD 80 billion US market over the next decade.

Catalysts for a short term bounce?

The market could see some support from the Fed as they cut interest rates in May. Trump recently threatened to fire Jerome Powell if he did not cut interest rates soon. He has long said that the Fed should cut interest rates.

On Friday 18 April, the White House ramped up its attacks on Powell yet again. White House economic adviser Kevin Hassett said that Trump and his team are assessing whether they can remove Powell from his position, although Powell defended that he cannot be fired under law and intends to serve through the end of his term as Chairman in May 2026.

The highest conviction remains high quality fixed income

In my last blog and in my first post for the year, I said that 2025 would be a bullish year for fixed income. I am still most convicted on fixed income. Bond prices are still up for the year, and it is a good time to sell equities and invest in high quality investment grade bonds.

Disclaimer

Seven Fat Cows is a publication for information purposes only. I am not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.