2025 Market Outlook: bifurcated growth across regions; potential slowdown if there is significant tariffs and trade wars

Expect further interest rate cuts in 2025. Equity valuations are expensive but if you have already invested in the market, just continue to enjoy the ride.

In my last blog on 23 November, I said that “Fund managers and professional investors will take some profit in the short term as they close their books for the year. Yet, the long-term outlook for risk assets remains bullish.”

The S&P 500 Index peaked on 6 December at 6090 and we witnessed a 5% market correction to 5832 on 20 December.

Barron’s said that the market correction was long overdue, explaining that “corrections are healthy and even necessary for (long term) bull markets. They help [to] shake out some of the so-called froth in the stock market, where prices run up too dramatically and get ahead of themselves.”

It is difficult to pinpoint where stocks will head in the short term, but what is clear is that US stocks are trading at rather lofty valuations. Historically, investors who bought into the market at the current P/E level received only a forward rate of return of 2.9% for the next 3-years. Which is barely enough to beat inflation.

Further, the latest AAII US Investor sentiment bullish and bearish survey points to increasing bearish sentiment, while bullish sentiment is weakening.

Lookback at 2024

2024 was characterized by lower inflation with higher unemployment in different regions. Central banks lowered policy rates and managed to engineer a soft landing scenario. Growth held up better than consensus while the prices of goods fell even within the backdrop of a more hostile geopolitical climate.

Global economic growth reached 2.7%, as US, Brazil and India expanded at a strong pace, while Europe and China disappointed expectations. Goldman Sachs research projects the global economy to expand at the same pace as in 2024. Laggard economies such as Japan, Germany and the UK would see stronger growth in 2025.

2025 a bullish year for fixed income?

Looking ahead in the new year, the new administration is expected to deliver on their promises during Trump campaign trail which include tariffs, deregulation and immigrant clampdown. This largely translates to continued US outperformance over other economies with elevated inflation.

As fund managers and traders return from their winter holidays to their trading desks after their new year celebrations, expect trading volumes to pick up.

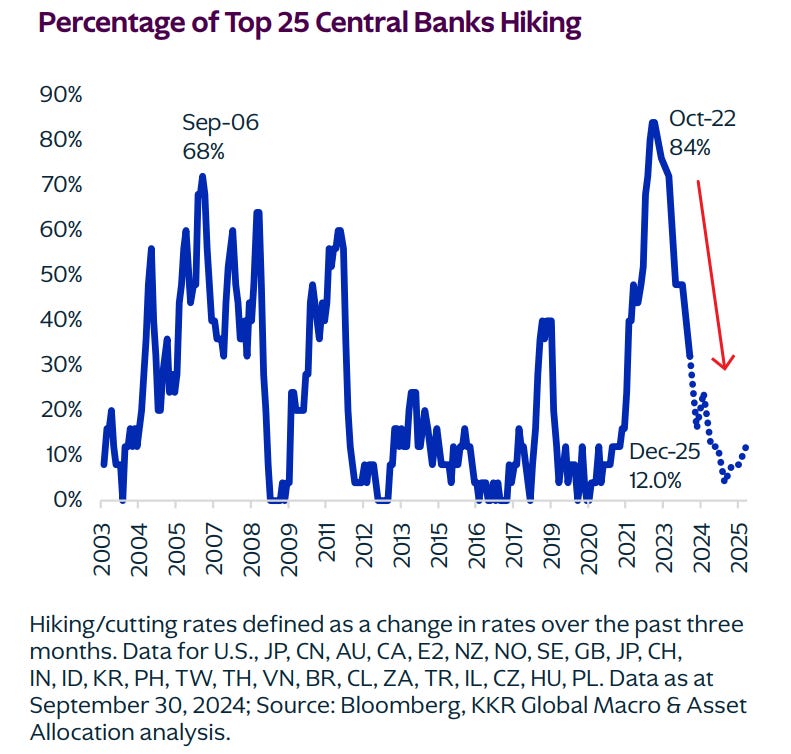

On the market front, institutional investors have been reducing exposure to fixed income as risk sentiment improved, with holdings at their lowest level in years. However, as central banks continue with rate cuts, I think that there will be a turnaround and an increased interest in the asset class in 2025.

As Western economies become more mired in debt, there would be a shift in power towards Asia and emerging markets, which could result in higher inflation and lower potential output. As protectionist measures rise, investors need to recalibrate portfolios for heightened volatility, and gradually increase the bias towards quality and exposure to fixed income assets.

Looking at yields across the different segments, the investment grade sector of the market is still providing a fairly decent pickup. Fiscal concerns and the reduced foreigner buying interest in US Treasuries have pressured yields. Duration for investment grade bonds meanwhile, are pretty sizable, which could provide the required lift when central banks continue on their rate cutting cycles.

If the trend on the Citi economic surprise index continues, global economic data could surprise to the downside, thereby giving the incentive for central banks to cut interest rates.

Across regions in the Citi economic index, US and Europe may disappoint but China’s economic data may surprise to the upside, provided we do not see excessive tariffs imposed on the country.

At this juncture, the market expects significant external pressures on China. It is difficult to see how the country will see an upturn and 2025 will be a pivotal year as China redirects its fiscal and monetary policies in the face of both external and domestic challenges. The risks are skewed to the downside in the face of complex domestic structural issues such as an ongoing property market slowdown, pressured household balance sheets, and industrial overcapacity.

Research from KKR projects slower growth in China, falling inflation, lower rates and a weaker CNY currency in the event of tariffs.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.