Treasury Secretary Scott Bessent: "There are no guarantees there won't be a recession."

Many companies have announced layoffs since Donald Trump became President. Unemployment is expected to rise and the growth outlook has deteriorated. Overall, it is a good time to sell stocks.

The Trump-Vance administration has swiftly implemented a series of controversial measures to reshape the federal government. The administration issued executive orders aimed at undermining the civil service and politicizing independent federal agencies.

Senior executives were fired, nonpartisan federal employees were replaced with partisan loyalists, and diversity, equity, inclusion, and accessibility staff were targeted for removal.

In addition to these internal changes, the administration implemented controversial trade policies, including the imposition of tariffs on Mexico and Canada, which were subsequently paused. These rapid and sweeping changes have raised concerns about the erosion of democratic norms, the politicization of government agencies, and the potential long-term consequences for the US.

The market has expressed its distaste for US stocks. Thus far, international stocks have outperformed US stocks since Trump’s inauguration day.

No confidence

The University of Michigan Consumer Sentiment Index plummeted to its lowest level since November 2022, dropping to 57.9 in March 2025 from 64.7 in February. This sharp decline, which was well below forecasts of 63.1, marks the third consecutive month of decreasing consumer confidence.

The plunge in sentiment is largely attributed to growing concerns over President Trump's sweeping tariffs and their potential impact on prices and economic stability. Consumers across various political affiliations have expressed frustration with the "frequent fluctuations in economic policies," making it extremely challenging for them to plan ahead. The deterioration in consumer confidence is particularly evident in expectations for the future, with consumers becoming increasingly pessimistic about personal finances, labor markets, inflation, business conditions, and stock markets.

Bonds have been rallying in 2025

In my earlier blog post on the market outlook for 2025 on 1st January, I said that this will be a bullish year for fixed income. Among my reasons, I cited the reduced exposure to fixed income among institutional investors, and how central banks will continue to lower interest rates. Low ownership of quality assets and further rate cuts would boost the appeal of fixed income.

I also said that Western economies are mired in debt, and there would a shift in power towards Asia. But the transition would be bumpy, with a rise in protectionist measures and elevating market volatility. The uncertain outlook and a volatile market environment is supportive for fixed income.

Fixed Income assets have indeed delivered positive returns this year. The long-end has outperformed (30-year up by 5.76%), while Mortgage-backed securities (MBS) and investment grade have done better than high yield (IG Corps vs US HY).

Going forward, higher rate cut expectations are likely to support demand for the long-end of the curve. Investors are also better off staying invested in the high quality of the market, as credit spreads are at their lowest levels in years.

Bad market call to buy GEVO, Inc. at $2.80

My previous blog post on GEVO, Inc. was untimely. The call to buy GEVO, Inc. at $2.80 was too early and coincided with its high.

One of the primary reasons for Gevo's stock price decline is the company's ongoing financial struggles. As of January 2025, Gevo was facing negative profit margins and high debt ratios, indicating persistent operational difficulties. These financial challenges have raised concerns among investors about the company's ability to achieve profitability and sustain growth in the near term.

Market sentiment also impacted Gevo's stock performance. Despite some positive developments, such as strategic partnerships and progress in sustainable aviation fuel ventures, the stock has been subject to speculative trading and volatile price movements. This volatility, combined with broader market uncertainties, has likely contributed to the downward pressure on Gevo's stock price.

Additionally, external factors have impacted Gevo's prospects. The company's reliance on government support, particularly the USD 1.63 billion conditional loan commitment for its NZ1 project in South Dakota, has become a source of uncertainty. With the US administration change and recent setbacks in CO2 pipeline projects in South Dakota, there are doubts about whether this loan will be funded in the near future, or if at all. This uncertainty has dampened investor enthusiasm for Gevo's long-term projects.

However, the stock still sits in the portfolio and I am inclined to dispose it with a sharp loss at a later time during the year.

Recession on the cards?

According to the latest numbers, global economic activity has slowed in February. Manufacturing dipped below 50 in February. Nearly all countries see lower PMIs in February compared to January with the exception of India, Japan and Germany. France is at the bottom of the decliners, going deeper into contraction territory.

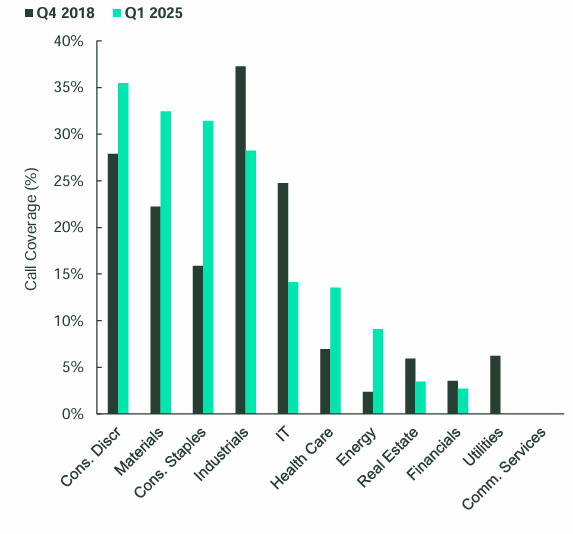

Further, more companies have quoted tariffs as a concern in their first quarter conference calls.

Consumer companies are probably the most impacted by tariffs. The two sectors that would be less immune from tariffs are financials and real estate.

Here is the most concerning indicator in my view. The Atlanta Fed's GDPNow model estimate for annualized growth for the first quarter was a stunning -1.8%. At the start of February, the model showed that growth in the January-March period was tracking close to +4.0%. That’s a sharp drop.

Treasury Secretary Scott Bessent says corrections are ‘healthy’ and ‘normal.’

As Jim Cramer argues it, the recent sell-off has to do with a lack of consistency and a lack of certainty coming from the White House. The President’s erratic policy messaging has dampened confidence, leading to a pullback in spending from the private sector. While market corrections may be healthy, Jim says not all corrections are the same.

Higher rates have historically caused, and lower rates ended, the most corrections, followed by higher unemployment and exogenous shocks. Corrections associated with job losses should be the most feared because they typically see the largest falls and last the longest. This is probably because they are the most likely to see corporate earnings fall the most, alongside a drop in equity market valuation.

Disclaimer

Seven Fat Cows has a long position in GEVO. I am not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.