The Secret to Building Wealth

If you did not know, the secret to building wealth is dollar cost averaging.

What is Dollar Cost Averaging / Regular Savings Plan?

According to Investopedia, “Dollar-cost averaging is a simple technique that entails investing a fixed amount of money in a fund (unit trust, mutual fund or exchange traded fund) or stock at regular intervals over a long period of time.”

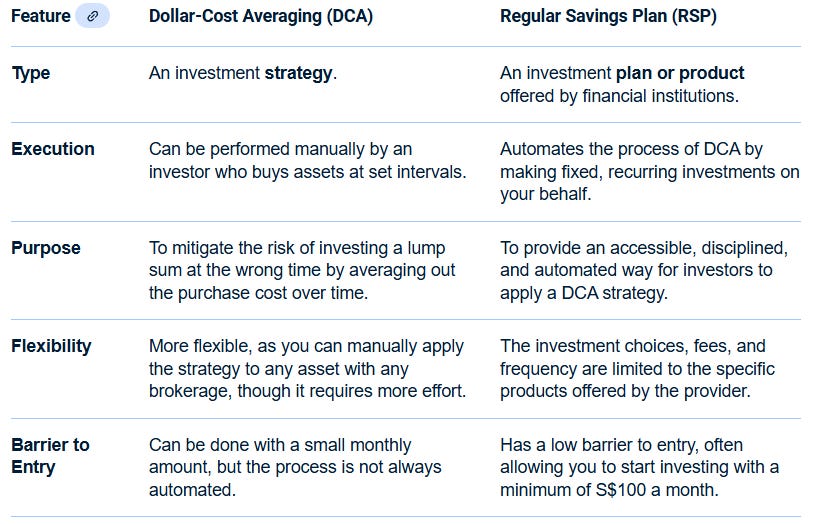

The key difference between DCA and RSP is that Dollar-Cost Averaging (DCA) is an investment strategy, while a Regular Savings Plan (RSP) is the platform or mechanism used to execute that strategy automatically. An RSP automates the process of DCA by regularly investing a fixed sum of money into a particular investment.

If you have a 401(k) retirement plan, you are probably already using this strategy.

If you reside in Singapore, you have the Central Provident Fund (CPF) Contribution Scheme, which is a mandatory social security savings plan funded by contributions from both employers and employees to help members save for retirement, housing, and healthcare needs. Members earn 2.5% per annum in their CPF-OA account or they may invest OA funds into CPFIS instruments.

There are some very good write-ups on Dollar Cost Averaging available on the world wide web.

Please feel free to click into any of these links to have a better understanding of what this simple strategy is about.

Dollar cost averaging: An easier way to navigate volatile markets (Manulife Singapore)

How using Dollar Cost Averaging Will Build Long-Term Wealth (Standard Chartered)

What to know about dollar-cost averaging (DBS Bank)

The Absurd Effectiveness of Dollar-Cost Averaging (Stashaway)

Dollar-cost averaging and its long-term wealth-building benefits (Endowus)

There’s nothing average about dollar-cost averaging (Merrill Lynch)

The fact that we have so many financial institutions advocating this method, shows that the DCA/RSP strategy is the easiest way to increase your wealth over time!

Dollar Cost Averaging versus Lump-Sum Investing

Unlike DCA, Lump-Sum Investing involves investing all at once right away.

In an analysis of more than 1,000 overlapping, historical seven-year periods, Morgan Stanley Wealth Management’s Global Investment Office found that lump-sum investing generated slightly higher annualized returns than dollar-cost averaging in more than 56% of cases.

It suggests that, in 44% of the cases, dollar cost averaging outperformed lump-sum investing.

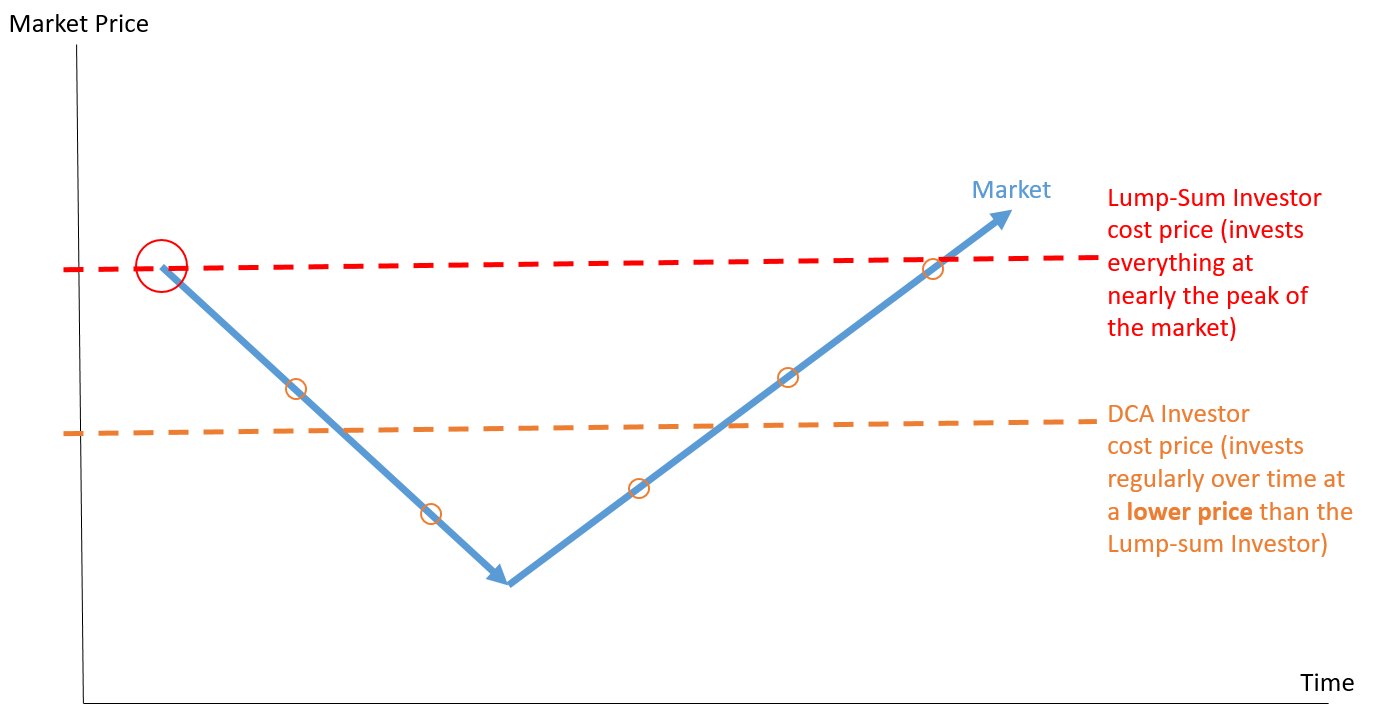

Here is an instance where dollar-cost averaging does better than lump-sum investing.

When the market crashes, the person who performs DCA receives a lower price over time and outperforms the lump-sum investor during the recovery.

The key is to put all of your capital to work

As a matter of fact, random instances of lump-sum investing over time is equivalent to a messy form of dollar-cost averaging.

You want to do in a structured and methodical manner such that you maximize the output i.e. all of your capital is put to work in the market by dollar cost averaging every month.

So, the question is - could there be a better way to Dollar Cost Average?

Yes, there is. And I have discovered one method on how to outperform DCA/RSP.

You see, it’s not only about what you invest in, it’s also about how you invest.

Introducing the DCA/RSP model portfolios

I’ve created the model portfolios as a guiding post for long-term investors who prefer to accumulate capital and build generational wealth.

These model portfolios are designed to outperform markets.

I publish the returns of my dollar cost averaging (DCA) USD and SGD model portfolios in my regular articles.

I have designed these portfolios so that they are really very easy to follow. The USD and SGD model portfolios are benchmarked against the SPY ETF and 2.5% rate respectively.

Introducing the USD DCA/RSP model portfolio

The Seven Fat Cows USD model portfolio is designed to outperform the SPY ETF in the long run. That’s the portfolio’s investment objective.

This model portfolio is really a result of years and years of investment research.

For those who do not know, the SPY is the largest exchange traded fund that is benchmarked against the S&P 500 Index (with USD 664.9 billion of AUM).

Here is the model portfolio’s performance against SPY, starting from 31 October 2017.

Assuming a USD 2000 monthly contribution, we can clearly see that the USD model portfolio has outperformed the S&P 500 Index fund.

If you become a paid subscriber, I will tell you the exact composition of the USD model portfolio, as well as guide you step by step how to invest every month. I will break down every holding in detail.

Introducing the SGD DCA/RSP model portfolio

Unlike the USD model portfolio, the Seven Fat Cows SGD model portfolio is designed to outperform CPF OA 2.5% rate in the long run.

This portfolio is constructed using CPFIS eligible instruments. Holding details and portfolio weights will be made available to paid subscribers. So wait no longer, upgrade your subscription to a paid version today!

Here is the model portfolio’s performance starting from 9 March 2022.

Disclaimer

Seven Fat Cows is a publication for information purposes only. I am not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances before investing. Terms & conditions apply.