Fed Chairman Powell says "The time has come" to cut interest rates

As inflation fades, market indices are likely to continue rising but value will outperform momentum over time.

In my last blog on 3 August, after the market experienced a steep correction in July, I said that it was not a time to sell stocks.

Subsequently, the S&P 500 Index rebounded off a bottom on 5 August and nearly recovered back to its previous record high.

CrowdStrike Holdings, Inc

I also mentioned that Crowdstrike stock was oversold at $216 per share.

Since then, Crowdstrike had rallied to $271 per share. At this level, I have no further comment about the company as the technicals are more difficult to predict with the company reporting earnings on 28 August; given the heavy underlying options volume, we could see some swings in the stock price after the earnings announcement. Overall, I am neutral and maintain my view that the firm’s financial profile has weakened after the recent outage.

In my previous blog, I also highlighted that the Federal Funds market is pricing a 100% probability of a rate cut in September.

On Friday 23 August, Fed Chairman Powell said that the “time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

In addition, the Fed said that the “upside risks to inflation have diminished” while “the downside risks to employment have increased” but “with the appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labour market”.

Interest rate cut probabilities

Market implied probabilities for a rate cut has not changed since the start of the month - most participants still project a 25bps reduction to 5.00%-5.25%.

Looking at the November FOMC meeting, the Fed Funds futures market is projecting more rate cuts, to possibly, as low as 4.25%-4.50%.

Yet I believe, if the economy displays continued resilience or if the stock market continues to keep rising in October, the likelihood of US interest rates falling to 4.25%-4.50% is not probable.

Taking a step back to look at the global economy - we see that economic data is pretty soft across various indicators. In fact, the broad expectation is for a soft landing or no landing scenario going forward.

Across economies, consensus see lower growth in China as we head towards the end of the year, with better real GDP growth in Europe and Japan next year.

One of the potential drivers of growth in Europe is lower interest rates. But what could make Europe more compelling next year is if developments on the geopolitical front between Ukraine and Russia improves.

As I write, Ukraine has invaded Russia and is expanding attacks inside the country. Any peace settlement between the two countries or a Russian surrender would certainly be a catalyst to market sentiment.

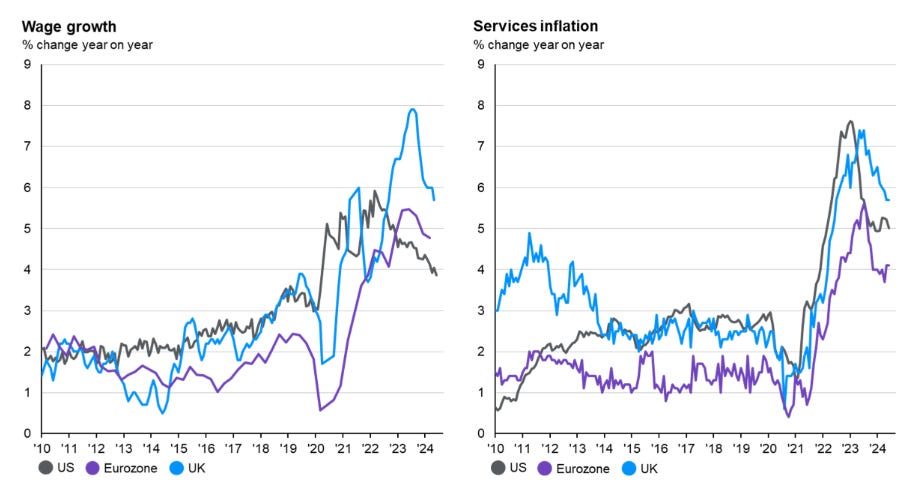

With respect to jobs, wage growth is in free fall globally as service inflation decreases.

As for manufacturing sector PMIs, majority of European companies are pessimistic about the future (mostly in red) while India and Taiwan are more optimistic about expansion (Any number above 50 is good as it shows an expanding sector).

Valuations for equities are still not expensive, relative to history. The MSCI World Index trades at a forward P/E of 16.3x, which is above average but still not as high as levels prior to the Covid outbreak.

Looking at recent returns, small cap companies have outperformed other sectors while commodities and the US dollar have dropped. Large cap companies still lead over the 12-months, but small cap companies are catching up in terms of returns.

I continue to like small firms and would be looking to add names to the portfolio as we head towards the end of the year.

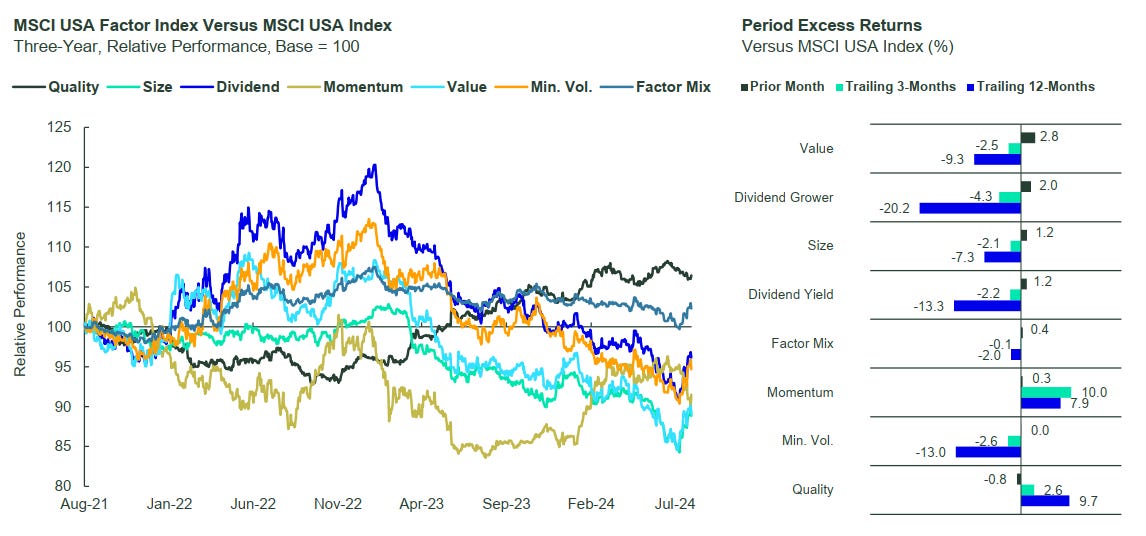

A new leadership is emerging in the US stock market. Focusing on performance over the last month, the chart below illustrates that value and dividend styles outperformed quality and momentum. With the recent correction, momentum may not be as profitable as other strategies. In other words, holding stocks for dividend plays and buying on cheap valuations for longer periods may be the best option for the next few months.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.