With higher unemployment and recession fears on the cards, is it time to sell stocks?

Rising unemployment led to panic selling and recession fears over the week. The economy may be weakening but it is not the time to sell yet.

As I had anticipated two weeks ago on 20 July, the so-called ‘largest IT outage in history’ would lead to profit taking in the technology sector.

Since then, the NASDAQ 100 dropped by more than 5% to 18440, led by a selloff in the Magnificent 7 (excluding Apple, which reported better than expected earnings)

Two weeks ago, I also warned not to buy Crowdstrike stock as the company could be liable for potential lawsuits by companies who faced disrupted services. Consequently, Crowdstrike stock has plunged since the outage.

At $216 a share right now, the stock is presumably oversold and some buyers may come in to scoop up shares. But overall, I think the company’s financials could deteriorate over the longer term as we still do not know the full extent of its reputational damage.

I also wrote that the VIX Index would rise, on seasonal effects, which typically stretch from August to October. Since then, the VIX has soared to nearly 30 from 15 on 19 July.

Third, I also mentioned that bond yields would fall in the days after (which they did), and I predicted that the Fed would cut interest rates at the July FOMC meeting.

However, to my dismay, the Fed did not lower rates in July as Chairman Powell was keenly focused on inflation risks, asserting that the bigger risk than recession is that inflation stabilizes at a level meaningfully above the 2 percent level.

At the meeting, it appears that the Committee is still very concerned about prices, as it was mentioned several times. It leads me to believe that the key indicator to watch going forward is consumer prices; the Fed said that they will certainly react if there is a reacceleration.

Thus far, the Fed’s indicator of inflation - Core PCE Index has yet to fall to 2%, having only dropped to 2.6% in June.

Among components of the CPI index, what is really required is a fall in rents and service prices, which have stayed at stubbornly high levels.

A few weeks ago, I already foresaw that the US job market data would be disappointing as unemployment had been creeping up. Now that the July payrolls are out, confirming weakness, the Federal Funds futures market is pricing a 100% probability (80% 25bps cut, 20% 50bps cut) that the Fed would cut interest rates in September.

A rate cut would benefit the economy. For one, it will lower the cost of mortgages for homeowners. Long term bond futures have risen (i.e. Treasury yields have declined), and the 30-year mortgage rate has plunged in tandem.

Spreads between short term and long-term yields have widened, creating a steeper curve, which might attract more investors to buy bonds. I still like higher risk assets but within the fixed income market, I see the most potential for emerging market sovereign bonds as geopolitical tension looks to be simmering towards the end of the year.

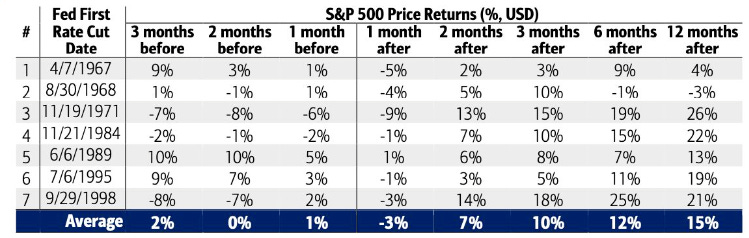

If there is a rate cut in September and provided we don’t have a recession, stock investors would still benefit more than bond investors. Here are the past returns calculated by BofA for the S&P 500 Index in non-recession years after the first rate cut.

Magnificent 7 will become Magnificent 493

The selling pressure in the stock market may intensify over the next week, but I am sure value investors out there will be on the lookout for bargains, especially if stocks step into oversold territory. According to analysts, earnings for the 493 stocks outside of the Magnificent 7 is projected to improve till 2Q2025. Concurrently, earnings growth for the Magnificent 7 would slow. Suggesting, that (1) a new market leadership would emerge (2) the medium term bull market is still intact.

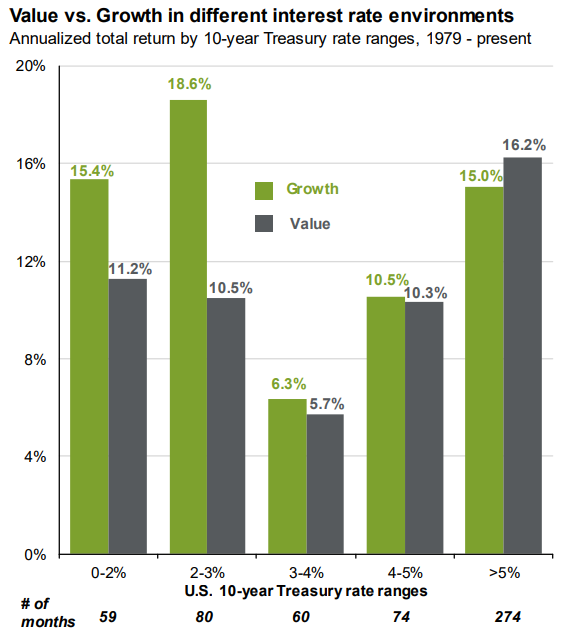

On the point of a new market leadership, I think value stocks would outperform growth stocks in a high interest rate environment. Over the past decades, value companies provide better returns to shareholders when US Treasury yields are high.

From a valuation perspective, the small cap sector looks interesting. Earnings yield, or the inverse of the P/E ratio shows that the Russell 2000 is trading at around its cheapest level in 20 years, relative to the S&P 500 Index. Small caps may lead the next equity rally and with that said, I have added a small cap ETF to the portfolio.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.