Donald Trump winning US election is fantastic news for America, but not the best news for China

President Trump is likely to impose tariffs on imports, freeze climate-related regulations and deport immigrants.

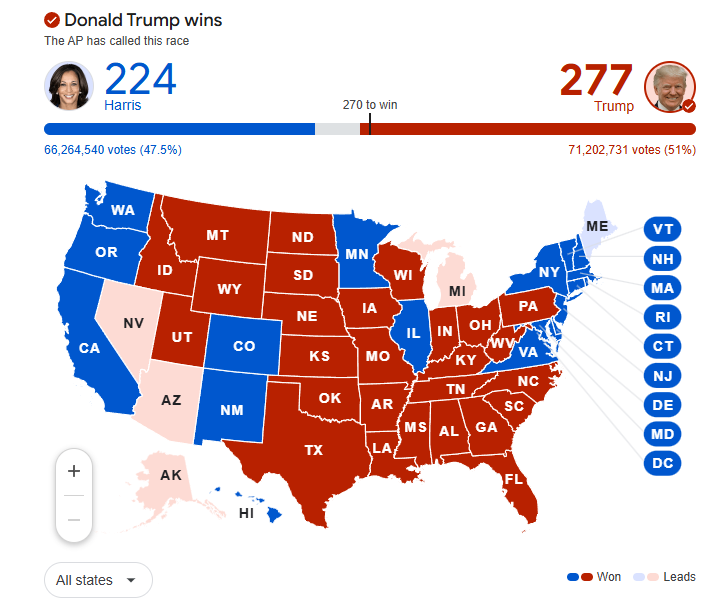

It will be a Red sweep as Republicans win control of the US Senate, which would make it easier for President Trump to enact his agenda.

Great News for America

Donald Trump could remove or lower taxes for the American people. Tax cuts from Trump’s first term are set to expire at the end of 2025 but he could extend those tax cuts and introduce new ones, including the ending of taxes on tips and allowing a deduction for auto-loan interest.

Secondly, Trump is for the middle class and he will do everything to lift disposable income and help people afford the cost of living.

Broadly speaking, more deregulation and tax breaks would definitely be a boost to US growth.

Harris Win and Rate Cuts

In my earlier blog (Sentiment is high and the market is set to skyrocket till the end of the year), I said that a Harris win and rate cuts would lead market sentiment higher towards the end of the year.

Sentiment is indeed high but a continuation of Biden’s policies is not going to happen.

I was really surprised to see Donald Trump re-elected and it’s time to re-visit my investment thesis.

T for Tariffs

When in office, Donald Trump is going to impose tariffs on all US imports ranging from 10% to 20%, and up to 60% tariffs on Chinese goods.

This is obviously not the best news for Chinese exports (electric vehicles), Mexico and Canada.

In my earlier blog, I called for a rally in Chinese stocks.

The Shanghai Composite Index did rise higher after my blog publication to an index level of 3386 - in fair honesty, the gains were lower than my expectations as the market wasn’t entirely convinced about strong China growth moving forward while property remained a drag.

With the US election results today, I am less bullish on China as there will be a new drive to Make America Great Again. To be clear, I am not bearish on the country, but I feel that there are other better opportunities in capital markets elsewhere.

Higher-rates-for-longer?

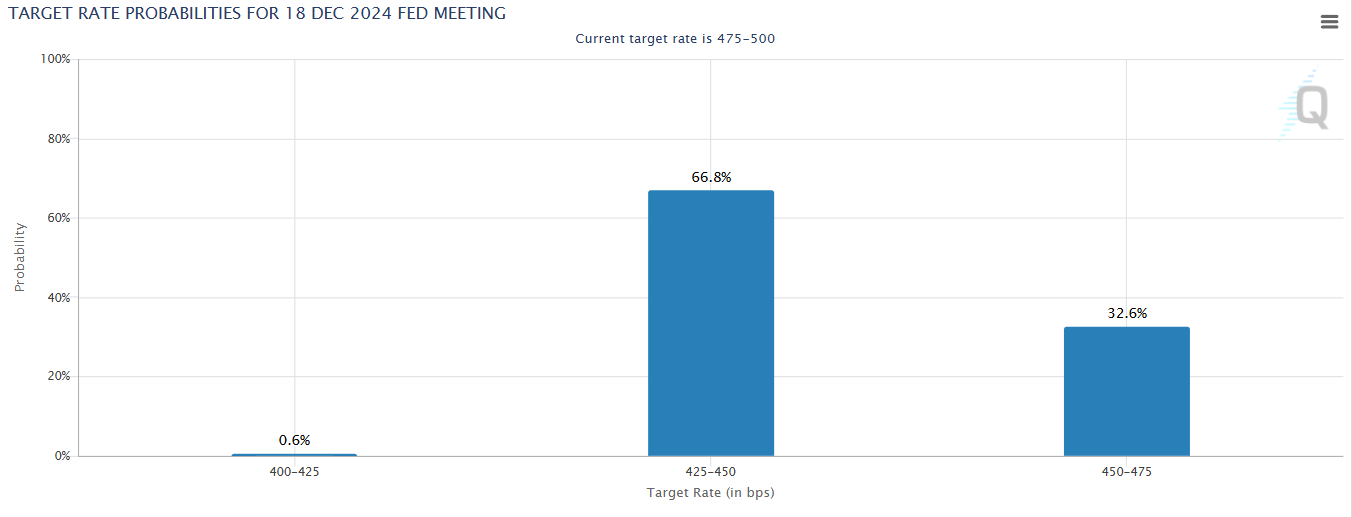

The FOMC will gather tomorrow and decide on interest rates. Inflation has declined and unemployment has risen and the market believes that it will be a 25 basis point cut in November. As of today, the futures market is also anticipating a rate cut in December - from the chart below, there is a 66% probability that rates fall to 4.25%-4.5% next month.

While the Fed may cut interest rates in November, I think US Treasury yields will face upward pressure in the near term for obvious fiscal reasons.

Think about how Trump is going to cut taxes which will lower government receipts. Inflation may also rise because of the tariffs he will impose on imports, which would force the Fed to hold interest rates.

Overall on Treasury yields, I maintain my stand that yields will remain high as government spending will stay elevated. We really need to see how Trump is going to increase tariffs, boost tax revenue and reduce the federal deficit in order to turn bullish on Treasuries and investment grade fixed income in general.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.