Sentiment is high and the market is set to skyrocket till the end of the year

Fed cutting rates and a Harris win in November is good for stocks.

Here comes the rally in China stocks

In my previous blog, I wrote about the strong market rally in Chinese stocks (Read : Chinese stocks delivered its best week since 2008. Is it time to buy China? )

I said that the bus has moved and there will be a short covering in Chinese stocks. However, I cautioned that I would like to see more momentum before turning bullish on Chinese equities.

The Shanghai Composite Index soon rallied after the blog post on 28 September but corrected about 10-15% from its recent high.

In the blog, I also mentioned that the Chinese economy needed a push as it was trailing behind its 5% GDP target for the year.

Last week, China announced a third quarter GDP YoY growth of 4.6%, which was indeed below 5% but slightly exceeded the market’s expectations.

Optimism is high among Chinese stock investors. According to SCMP, investors are eager to see more substantial support for the economy. Finance Minister Lan Foan was quoted stating that the country has the room to raise the budget deficit, implying that we could see more measures coming out of Beijing.

For those who have been following China, unlike previous meetings, there was a shift in focus during the latest Politburo meeting, which seemed to highlight a sense of urgency to achieve its annual growth target.

This leads me to think, that the Chinese stock market could continue increasing from this point on. We might have already seen the bottom for stocks and the Shanghai Composite Index may exceed the high on 8 October.

Expect a rally till the end of the year

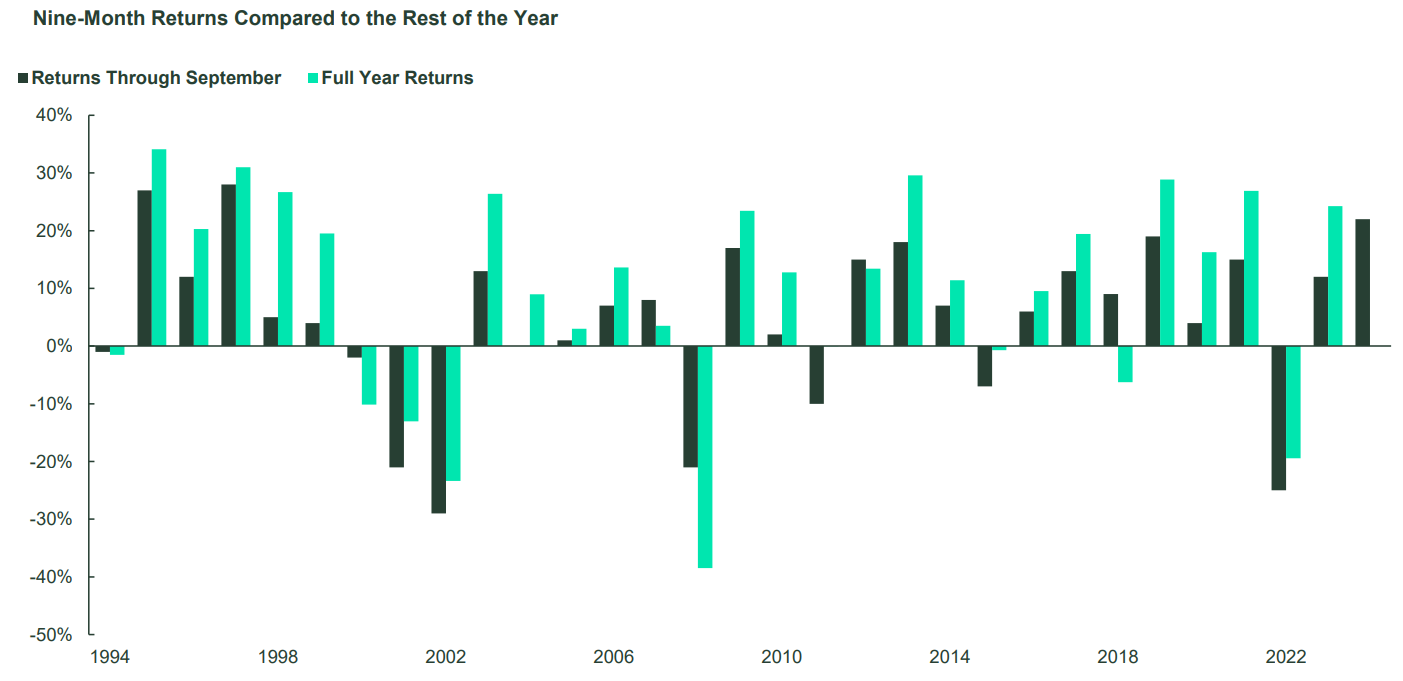

2024 has been a great year for global markets. The S&P 500 Index delivered its best nine-month YTD return since 1997. With that said, historically, full year returns have exceeded nine-month YTD returns in positive years.

This implies more upside for the equity market for the remaining months of 2024.

The bond market is expecting a Fed cut in November, which translates into lower borrowing cost for companies and higher returns on investment for equity holders.

Although interest rates are set to fall, we may still see some pressure on Treasury yields. (Read my earlier blog in June on the reason why - Can interest rates fall and US Treasury yields increase at the same time? )

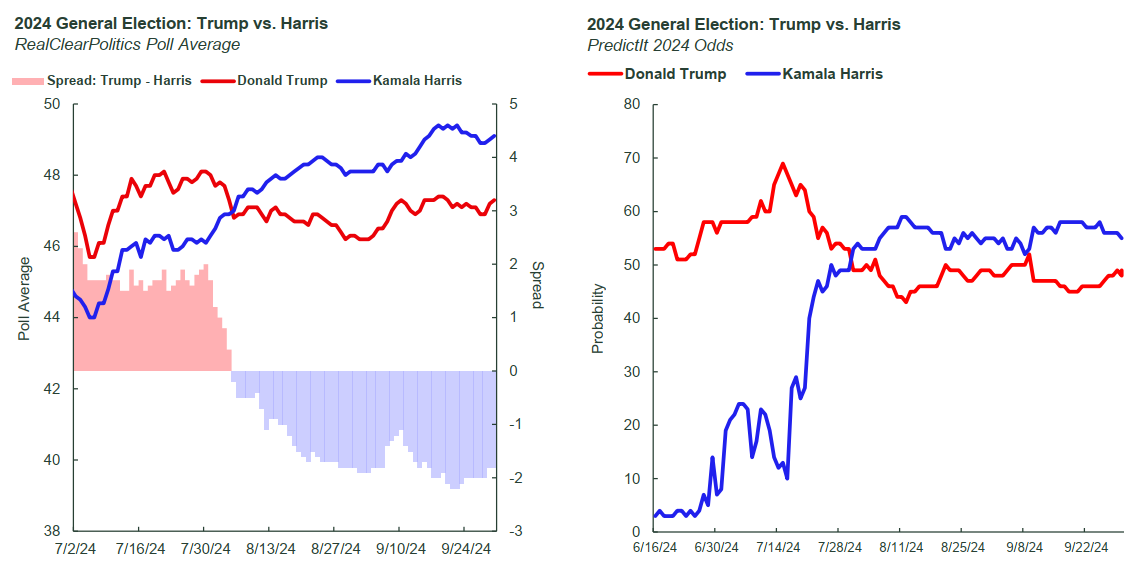

On the election front, the consensus is for a Harris win and we will see a continuation of the Biden policies.

If Kamala Harris is elected, and the Fed cuts rates in November, then the bull market in equities will continue.

Within countries, my favorite market is still Japan.

Given the fact that companies are adopting investor-friendly reforms, government incentives, increased tourist arrivals and high earnings estimates, Japanese stocks are notably attractive as they stand out from an EPS perspective (see chart).

It’s the travel season again

Another theme that can be played out for the equity market over the next few months are travel stocks.

Our model is currently suggesting a buy for this sector.

Despite majority of consumers saying that inflation will probably influence their holiday spending, travel activity is expected to pick up as December approaches.

The cruise sector for one, is set to benefit from higher travel activity.

Carnival, Royal Caribbean and Norwegian Cruise Lines have stated that bookings are at record levels for 2024, and 2025. These companies are trading at reasonable valuations after being beaten down by the pandemic.

Analysts are looking at the sector and most of them have grown more optimistic about the operators’ ability to remain profitable despite the high debt load.

(I will go into more detail about cruise companies in my next blog.)

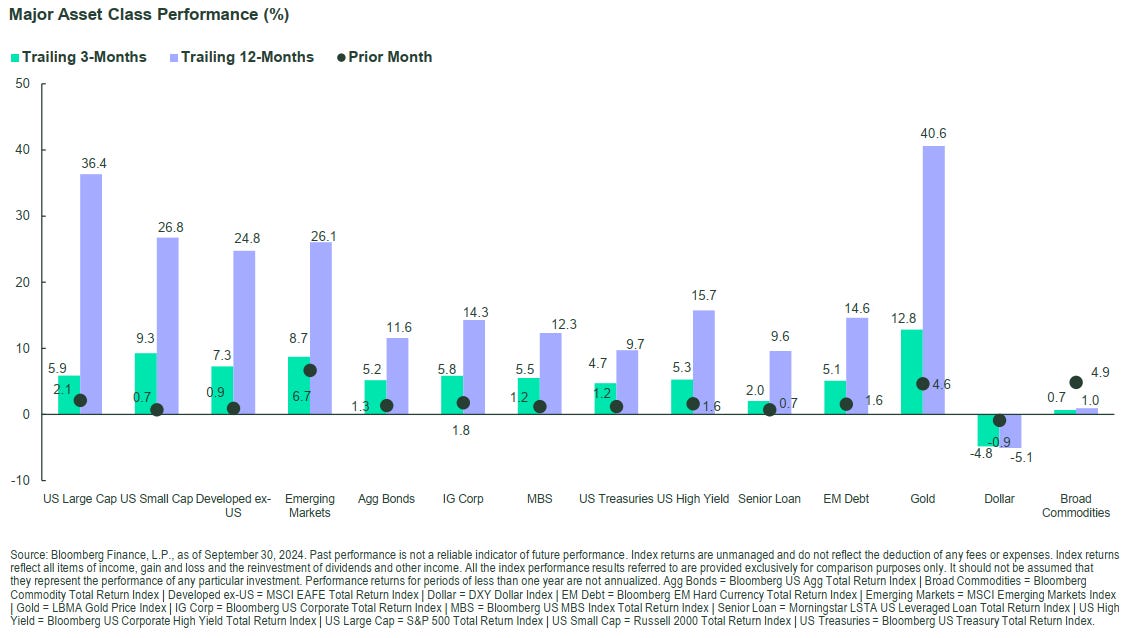

It pays to remain invested

If you bought and held anything (except the US dollar) over the last 12-months, there is no chance that you would have lost money. Of all the assets, Gold was the best performing, surging more than 40% over 12-months backed by concerns over geopolitical risks and a growing US fiscal deficit.

Investors who bought large cap US stocks made more than 36%. Commodities was the worst thing to own as there is a new trend on finding alternatives like renewable energy and substitute food source, depleting the demand for oil.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.