Interest rates to fall further as inflation declines to target levels. Market is exuberant so is it time to take profit?

Fund managers and professional investors will take some profit in the short term as they close their books for the year. However, the long-term outlook for risk assets remains bullish.

Central banks are cutting interest rates in response to lower inflation and growth headwinds. The US lowered rates in September, and other central banks will follow suit.

Some say that central banks will hold interest rates from this point on but the net interest rate cutting cycle, as measured by the orange line in the chart below does not indicate that the rate cutting cycle has come to an end.

Rather, it shows that interest rates are in the midst of a freefall, which often coincides with a period of economic strength, such as during 2007 and 2019 as depicted in the chart by JP Morgan.

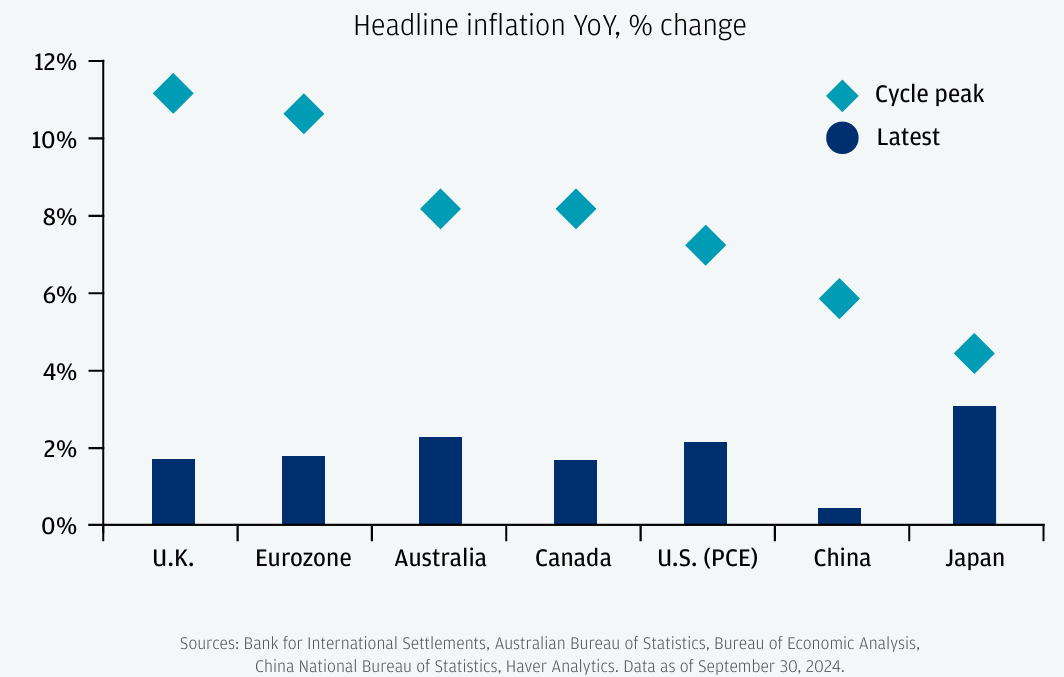

One of the strongest reasons to cut rates is that inflation has fallen back to the central bank’s target levels. Latest headline inflation readings show that they have already declined to around the 2% target level (with the exception of China).

As central banks cut interest rates, real GDP growth for OECD economies have actually improved and risen closer to their long-term average (see blue line in chart below), this comes as a breath of fresh air as growth has been staying below-trend for the past two years.

Looking ahead, as monetary policy stays accommodative, OECD growth may reach or exceed its long-term trend, which highlights a bullish case for developed market stocks.

Within developed countries, the market consensus is that the US is likely to outperform other countries with the Republican Party’s decisive victory in the recent elections. Market bulls argue that deregulation and lower corporate tax rates provide higher M&A activity and a boost to small-cap growth and domestic US consumption.

Research from JP Morgan Asset Management shows that most recent composite PMIs indicate that economic activity in the US has improved in September and October. Europe on the other hand is contracting but at a slower pace, while India and Brazil are witnessing healthy growth.

What is surprising however, is that the composite PMI for Japan has dropped below 50 (49.6) - which reflects receding activity.

Indeed, Japanese exports had declined in October as demand softened in China. On the political front, the Japanese government is also facing mounting pressure to rein in the cost of living, fueled by rising food prices. In response, Japan has recently passed an economic stimulus package to boost growth and help households cope with inflation.

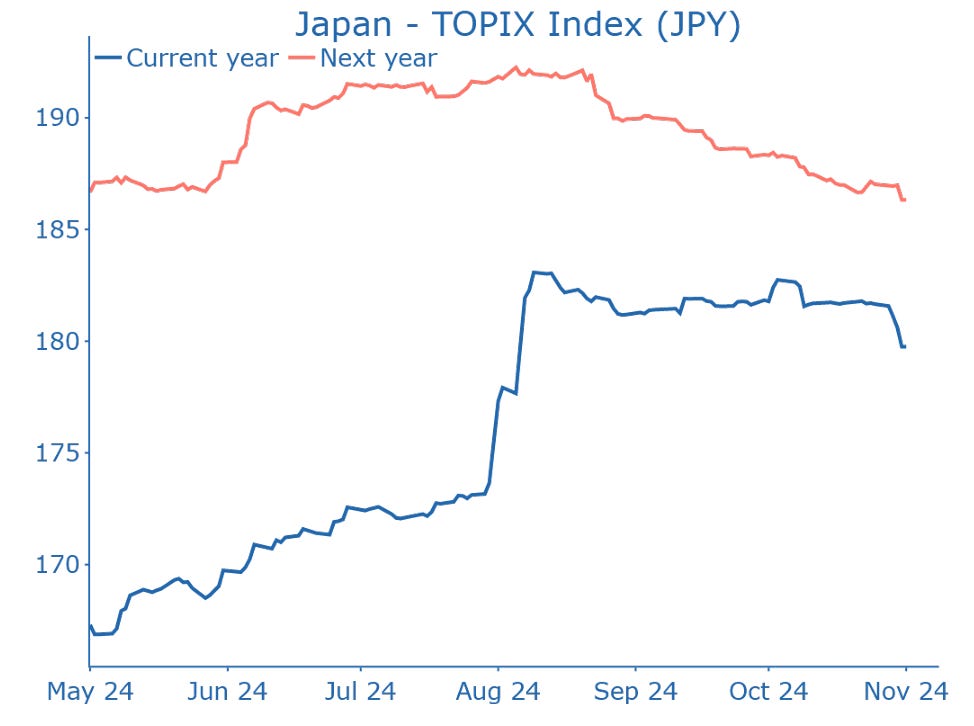

Downgrade Japanese stocks to neutral

Japanese stocks have been trading in a range while earnings estimates tracked by Bloomberg have been falling since August 2024. At the current level, Bloomberg estimates for 2025 are approaching 2024 estimates. This implies that companies are not likely to report a meaningful improvement in earnings next year and it makes sense to take profit in Japanese equities. Further, the Trump administration will impose tariffs on exports, which would weigh on Japanese corporate earnings.

Take profit off the table?

In other research, a breath of economic indicators show that Japan was impacted by recent natural disasters. Economic weakness was attributed to a megaquake alert in August and damage from one of the largest typhoons in decades that interrupted activity. When typhoon Shanshan hit, factory production was disrupted and the strong winds led to widespread train and flight cancellations.

Should I be buying stocks at this level?

No, markets are exuberant. Bitcoin, Gold and the S&P 500 Index are at record highs and there is a risk of a pullback.

Valuations are approaching stretched levels. P/E ratios have yet to reach their all time-highs (i.e. during the Tech bubble) and history tells us that the subsequent 10-year returns would be negative at the current P/E. I think investors can revisit investing in the market when the market retraces to a more reasonable valuation.

Investors are currently navigating a complex landscape characterized by a high market valuation and significant uncertainty surrounding the incoming Trump administration.

With the US Treasury market experiencing fluctuations and rising bond yields, some fund managers will consider it a prudent measure by taking profits on their investments towards the year end. Their motivation may be driven by several factors, including the unpredictability of Trump's policy agenda and the potential economic implications of his administration's decisions. As such, I expect some near term market volatility as smart money managers trim their profits to mitigate potential losses should the market take a downturn in response to unexpected policy announcements or economic shifts.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.