Update on VeChain/USDT and a few notes on the week ahead

US CPI, Trump-Putin summit and the US-China trade truce are on the cards

We provide an investment idea at the end of every article

Economic data is set to take center stage for investors this week, with uncertainty continuing to cloud the outlook for the US economy.

President Donald Trump is scheduled to meet face-to-face with Russian President Vladimir Putin, with a potential Ukraine peace agreement likely to be on the agenda. At the same time, a fresh round of corporate earnings reports is expected, and the deadline for the fragile US-China tariff truce is rapidly approaching.

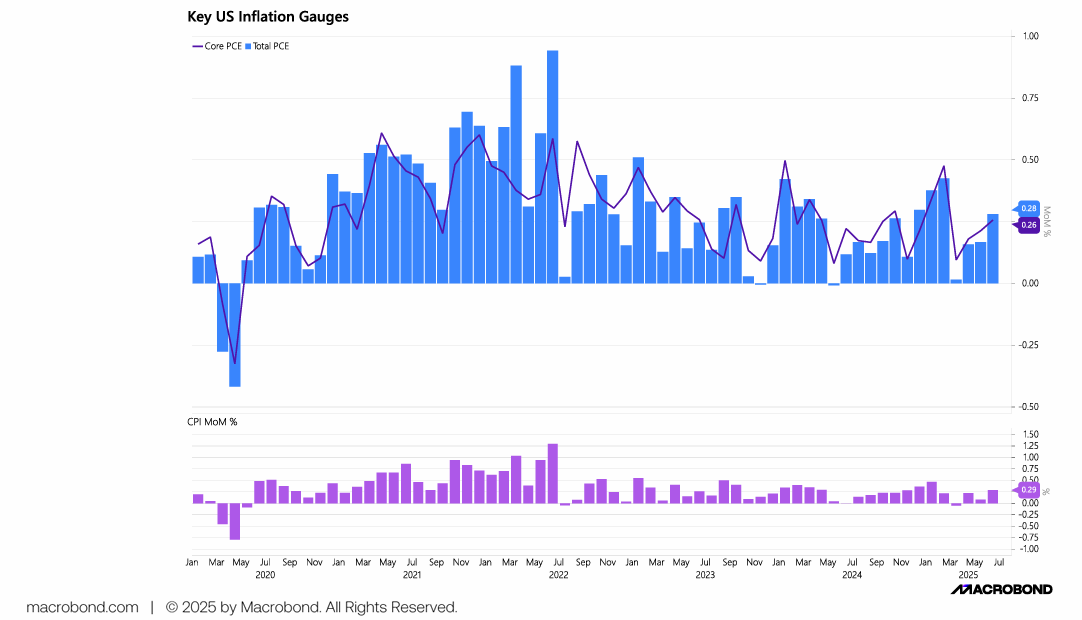

On the economic front, all eyes will be on Tuesday’s release of US CPI for July.

Courtesy of Macrobond, the chart on US CPI month-on-month change above suggest that prices may increase at a faster rate or stay firm at the current level.

This will be followed by Thursday’s report on producer prices for final demand, and on Friday, markets will see July retail sales figures alongside a new survey of consumer sentiment.

The US–China trade truce is poised to expire on Tuesday amid ongoing but so far inconclusive negotiations. An extension is possible, but uncertainty remains, with significant economic and geopolitical consequences hanging in the balance if higher tariffs are reinstated.

If no deal is reached or the truce is not extended, tariffs could revert to previous or higher levels triggering an escalation of the trade war. Such a scenario would likely disrupt global supply chains, impact market sentiment, and deal a blow to economic growth. Over the weekend, Trump called on China to “quadruple its soybean orders”

The market’s attention is expected to turn to the state of Alaska on Friday, where President Donald Trump will meet with Russian President Vladimir Putin to discuss a potential peace deal for Ukraine.

In remarks ahead of the summit, Trump indicated that any agreement to end the conflict—now in its fourth year—could involve both sides exchanging territory.

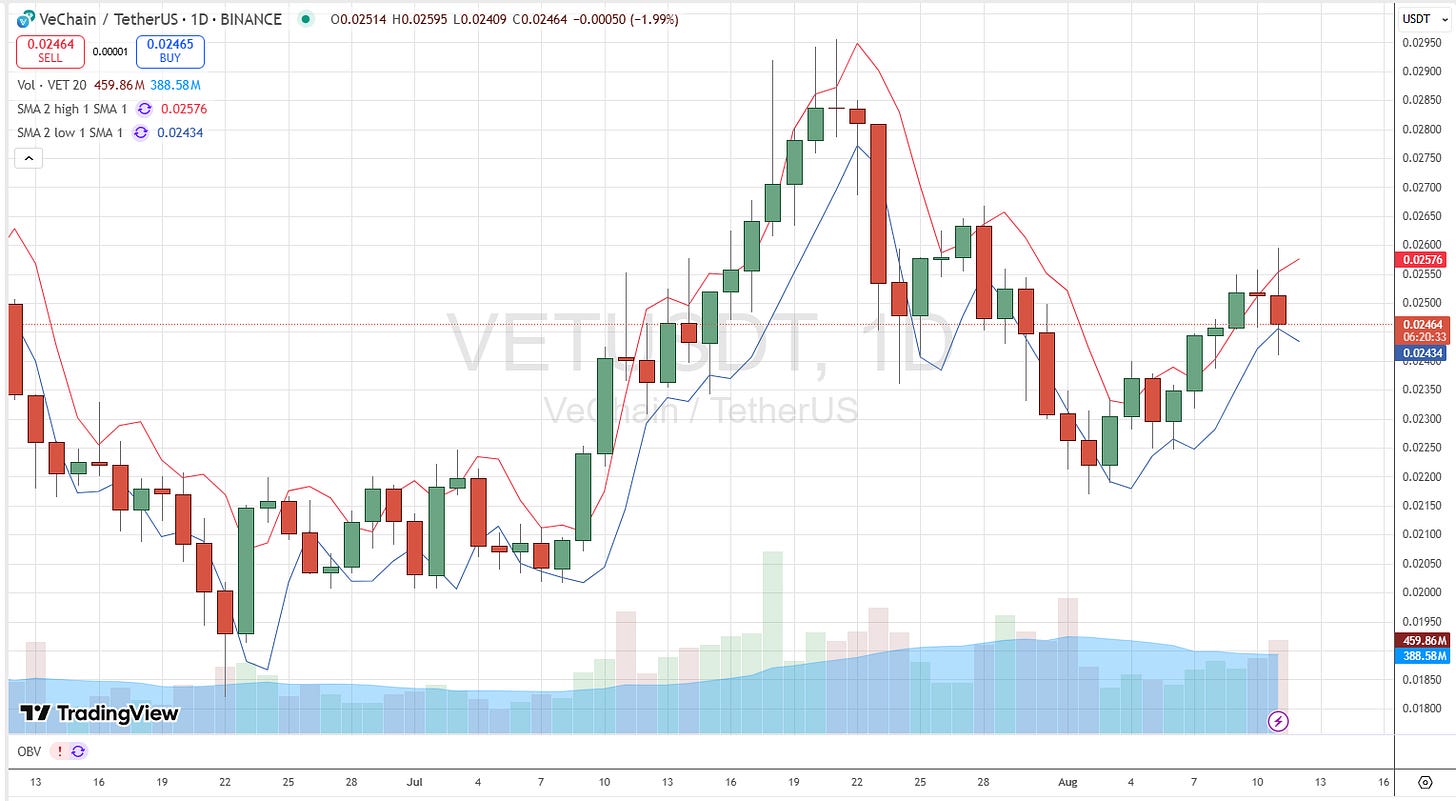

Update on VeChain/USDT

This may sound alarming but I am no longer bullish on VET/USDT, even though I wrote about the token yesterday in my blog when it was trading at 0.0248.

As I scanned the chatrooms over the weekend, I felt that the cryptocurrency was attractive. It has only been a day but the price action over the last 24 hours has been rather disappointing.

I recommend selling VET/USDT at the current market price of 0.02464, which translates to a loss of around -0.65% from 0.0248.

I did highlight that VET/USDT was a speculative market play, and sometimes, we need to act fast when market prices do not go in your direction.

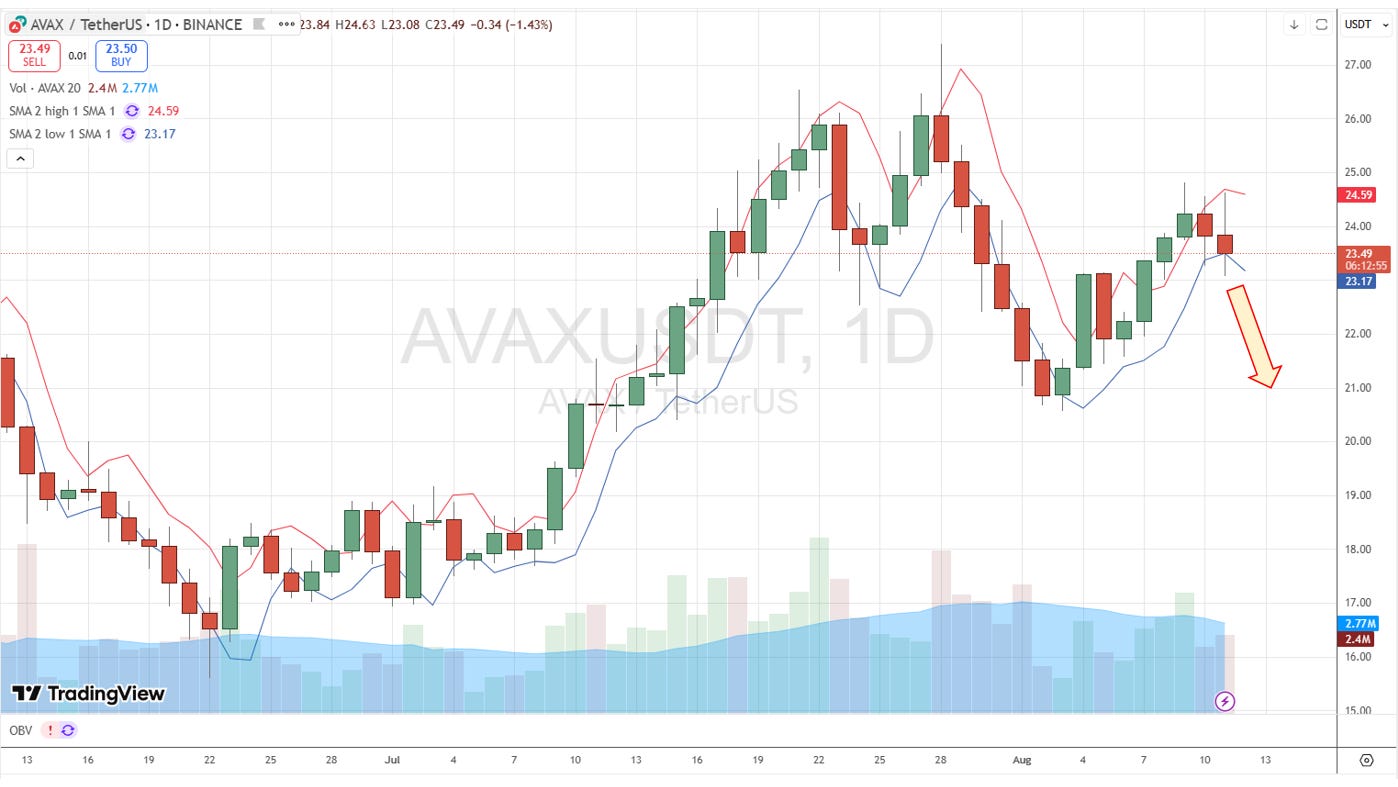

That aside, we have seen a good run in some pairs and I think that investors holding Algorand/USDT and Avax/USDT should take profit. Fastbull.com says that Avalanche will unlock 1.67 million Avax tokens on 15 August, which could add to selling pressure on the coin.

What looks attractive today

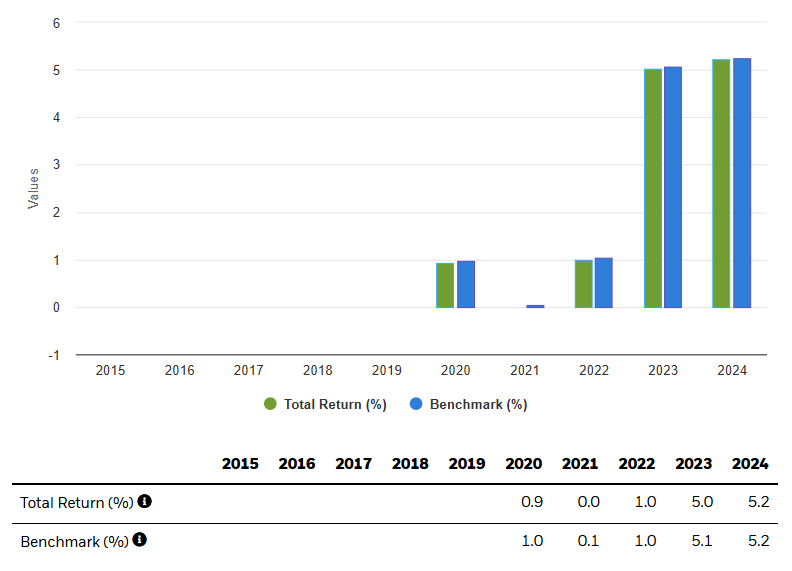

If there is something that I will invest today, it will be the iShares Treasury Bond 0-1year UCITS ETF, which had a yield-to-maturity of 4.15% on 8 August 2025.

This ETF is listed on the London Stock Exchange with daily liquidity.

According to Blackrock, the Fund was up 5.2% in 2024 and 5.0% in 2023. The effective duration of the Fund is 0.36.

Disclaimer

Seven Fat Cows is a publication for information purposes only. I am not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances. If you like our research, refer your friends and earn recurring income