Third Quarter 2024 Market Outlook

Here are some brief questions and answers for the third quarter of this year.

1. The S&P 500 is at an all-time high. Are valuations expensive?

The equity market has reached new all time highs several times this year. Some say it is too late to invest at this level, but valuations are not expensive compared to history. According to Macrotrend.net, the market was trading at a far higher P/E multiple during the 2000 Tech Bubble and prior to the 2009 Global Financial Crisis.

Overall, as long as US economic resilience remains in the backdrop, buying quality cheap US stocks on dips still makes sense.

2. Ray Dalio says now is the time to buy Chinese stocks. What are most other market participants saying about China?

China and India have embarked on different paths since 2021. Chinese stocks have been beaten down by the property market crisis, Covid pandemic and ongoing international trade disputes. On the other hand, India has risen to become the new growth engine of Asia.

From a technical standpoint, the Chinese market is trading at a cheap valuation by historical standards. As seen in the chart, the P/E ratio for the Shanghai Composite is near its record low.

Although valuations are cheap, one should also recognize that we are entering a new era of deglobalization. Trade restrictions have risen over the years, with more countries less willing to create new trade paths with each other, which weighs on global trade volume.

China is predominantly reliant on exports and more companies are moving their manufacturing bases out of the country. After the recent Covid pandemic, companies have realized the importance of diversifying supply chain risks.

Another headwind is that countries are increasing taxes on Chinese products. The G7 has been critical of China’s trade practices. Soon-to-be elected Donald Trump is also likely to go hard on China. After Beijing crashed the solar industry in Europe through overproduction, the EU is learning from mistakes and has imposed extra duties on Chinese electric vehicles with effect from July.

Broadly speaking, global trade fragmentation has increased and research suggest that we might be in the early stages of a cold war, which typically takes 3 years to end.

Bottomline is, China is still in a market bottoming process. Market bulls will fight back and it’s best to see more economic momentum before we can conclusively say that it’s time to invest in the country.

3. Will the French elections derail the markets?

Yes, the French elections is possibly the key market event that could set the tone for the rest of the third quarter. The country will hold a parliamentary election on 30 June and 7 July. If the outcomes are not great, financial markets could correct further.

The French bond market has been haphazard. France has been able to borrow from investors at approximately the same interest rate as Germany, but French OAT yields relative to German bonds have widened significantly. The market’s perception of risk in France has re-priced because of political risk.

Investors are concerned because credit rating agencies have downgraded the country due to the growing French deficit. France holds the record for Europe’s second largest deficit due to heavy spending during the Pandemic as well as Macron’s efforts to protect citizens from rising inflationary pressures.

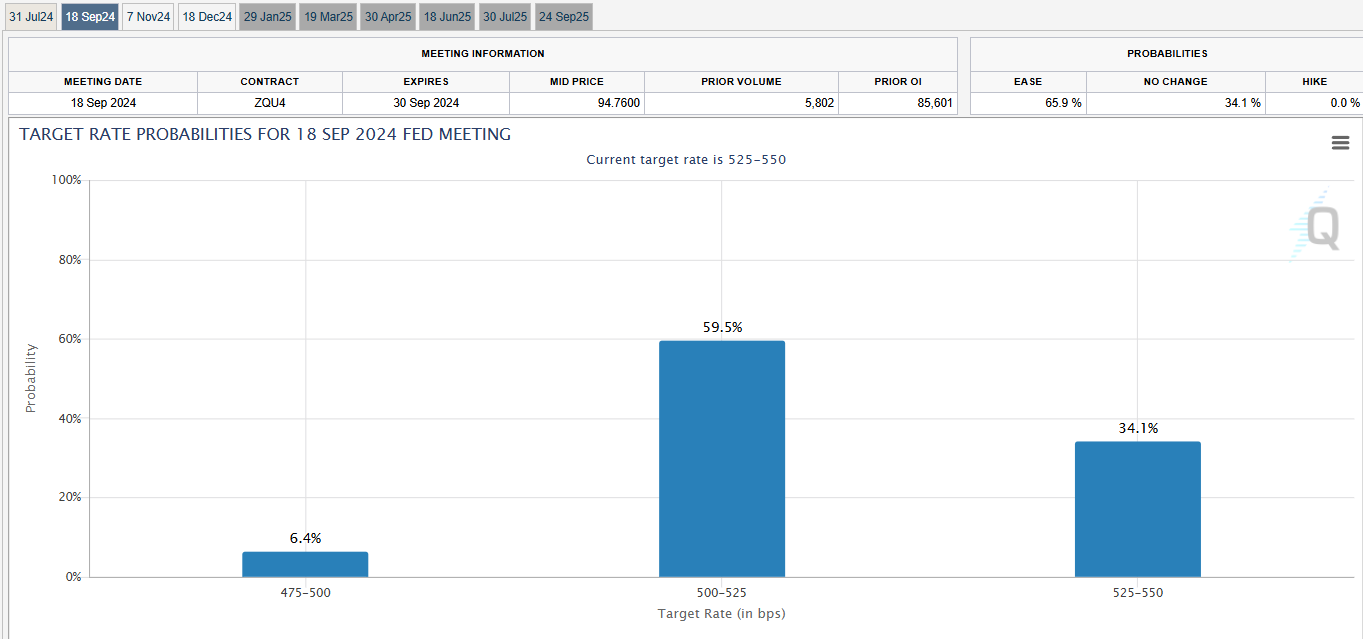

4. Will the Fed cut interest rates in the third quarter?

Investors are expecting no rate cuts in July, but there is a slight chance of a 25-basis point interest rate cut in September. Alot however, will still depend on how the job market and economic conditions evolve in July and August. Stronger than expected data in the US will lead the Federal Reserve to keep interest rates on hold for an extended period of time.

5. What other key events are there over the third quarter?

A. The UK will be having its general election on 4 July 2024. Polls suggest that UK PM Sunak could lose his seat in a Tory wipeout.

B. Thailand is conducting senate elections in June and results will be announced in July. It is a likely a non-event for markets.

C. MAS will announce its Monetary Policy Statement, which would sound more dovish than expected.

D. Top decision makers in China will hold a plenary session in July. We could hear major reform announcements that would lift Chinese sentiment.

Disclaimer

Seven Fat Cows is not a financial adviser. You should seek independent legal, financial, or other advice to check if the information from this website relates to your unique circumstances.